Often, even before a client talks to us, they will have chosen their research model and the overall rating question that drives much of their reporting and analysis. Private companies frequently dictate the use of Net Promotor Score (NPS) model although it isn’t as common for our public sector clients who may prefer an ‘Experience’ model.

What is the Net Promoter Score?

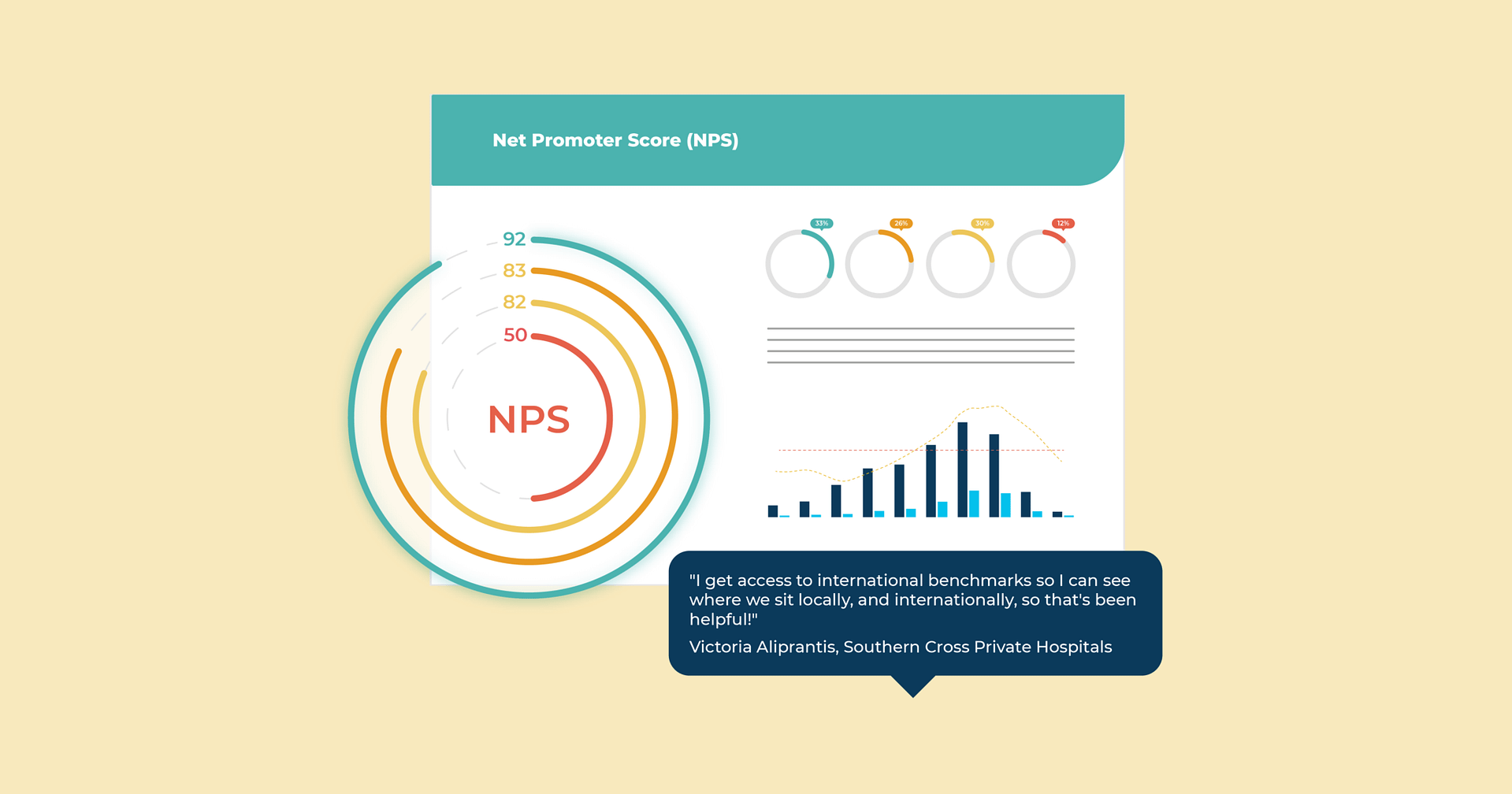

The Net Promoter Score is when someone is asked to rate, on a scale of 1-10, what the likelihood is they would recommend the service they experienced to friends or family. This scale is broken down into promoters (9-10), passives, (7-8) and detractors (0-6).

A NPS score is then calculated by subtracting the % of promoters from the % of detractors.

Why use NPS?

People who have come into the Health sector from commercial companies sometimes assume that the surveys they ran in other sectors are automatically the right choice for patient experience feedback. I’ll often suggest that they think about two factors before making their mind up about their patient experience survey.

Firstly, is a patient’s likelihood to recommend you to their friend and family a strong driver of your organisation’s performance? If so, NPS can be a good option. If not, there are better options. In many health settings there are well-validated, widely used surveys so it can be worthwhile reviewing these before finalising your survey.

Secondly, I ask people to keep an open mind about the length of the survey.

The terms ‘high involvement’ and low involvement’ are used to describe a customer’s level of engagement in a transaction. High involvement transactions are more complex, memorable and important to a person e.g. buying a car, choosing a wedding gift, being treated as a patient. Low involvement transactions are quick and quickly forgotten e.g. buying a coffee or newspaper, withdrawing money from a bank.

High involvement transactions are often characterised by the customer being clearly identified and providing their contact details at some point. A patient experience is clearly a high involvement interaction. Not only is a patient deeply involved, they understand how giving feedback on their experience can help others. There is much goodwill and motivation to participate.

Response Rates

I’m mentioning this to encourage people to distinguish between the types of surveys a bank or telecommunication provider might field compared to one asking for patient feedback. There is no evidence across Cemplicity programmes that a 2 question NPS survey will result in better response rates than a 20 question survey.

The more explicitly a survey seeks feedback on each key driver of a patient experience, the more actionable and useful the results. It is sad to go to the effort of implementing a Cemplicity programme and not take the opportunity to gather useful feedback from across the patient journey through a survey of suitable length. I’d add to this, that the most important type of question is the open-ended question – ones that enable patients to tell their stories in their own words. Patients are incredibly generous with their time and by allowing them to explain why they rated you as they did, you not only know what to improve, you know how to do it.